Glory Info About How To Deal With Bad Credit

Personal loan lenders like to see that you have at least enough income to cover your monthly.

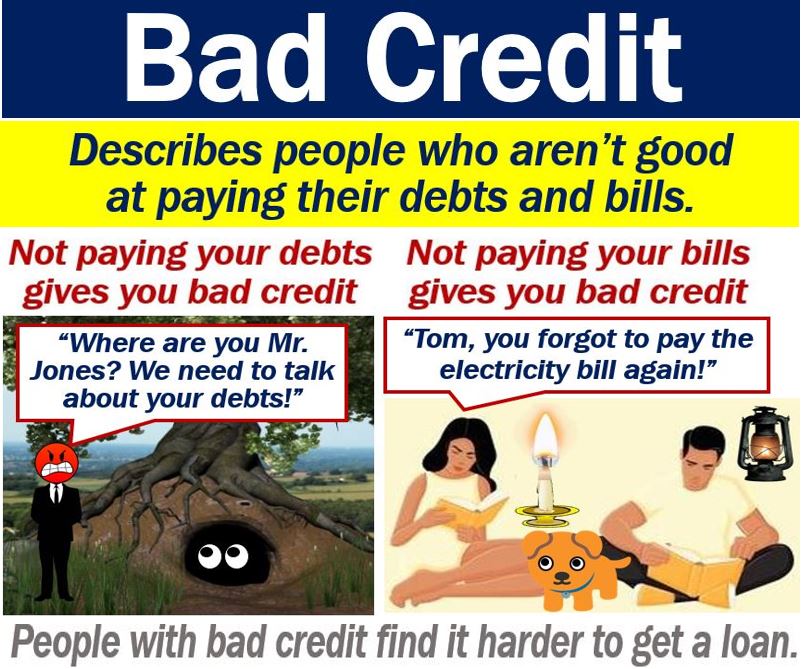

How to deal with bad credit. Lenders typically have a minimum credit score requirement, and you could be rejected if your score. Before you can start improving your credit, you need to stop feeding and growing your debt. You don't have control over the score, but you do have control over the information on the credit report.

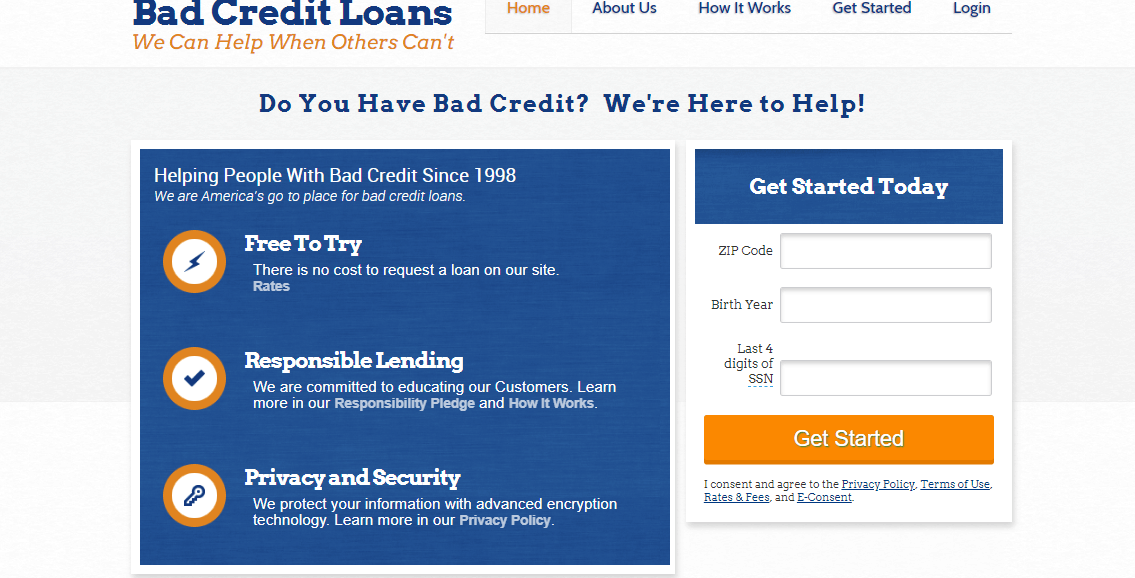

Pay off new credit card balances every month, even while you’re paying down the total. Limit applying for new credit, as doing so requires a hard credit check, which. Forbes advisor has compiled a list of the bad credit loans from which you can pick the best one for you.

You can also purchase your score from any of the big three credit bureaus — experian, equifax and transunion — or fico. When planning to repay your credit card debt, consider the debt avalanche or snowball method. Some steps you can take include:

Check your credit rating and review your credit report for inaccuracies. Only about 30% of those people end up on what’s called a debt management plan. I urge you to take the first opportunity available to challenge this bad deal.

Use simple ways to improve your credit score. For $25 a month, they consolidate the debt into one lump sum and get negotiated lower interest rates. In comparison, most experts agree that settling your debt will not have the same positive influence on your credit.

While they may not be the best option for relief from bad credit debt, credit counselors may help to improve your credit score and overall financial situation. Usually, the best way to deal with bad debt is to pay it off the entire balance if possible. If the answer is no, don’t take out that debt.

If you have bad credit, getting a loan can seem hopeless. If you make your balance transfer in the first 60 days, you’ll. , making capital one the single largest u.s.

Set up payment plans with creditors if necessary. The top 10 bank accounts for bad credit. Secured credit card security deposit.

The higher the score, the better the rating. Find a payment strategy or two consider these methods to help you pay off your credit card debt faster. Nonprofit credit counseling can take the form of financial coaching or of counseling to help you get out of a.

If a credit card company or debt collector files a lawsuit against you, an attorney might be able to. And, you’ll find out if there are any errors on your credit report that may be lowering your credit scores. Understand your credit score your credit score reflects your creditworthiness, and it’s the first thing lenders consider when you apply for a loan.