Nice Info About How To Increase Internal Rate Of Return

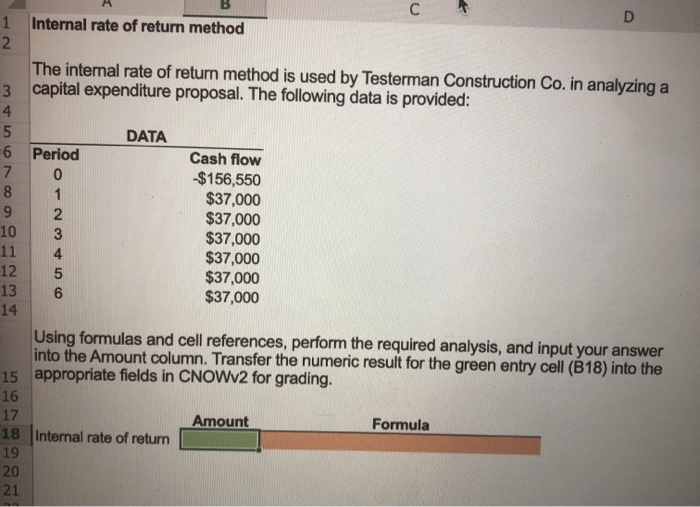

Since we are dealing with an unknown variable, this is.

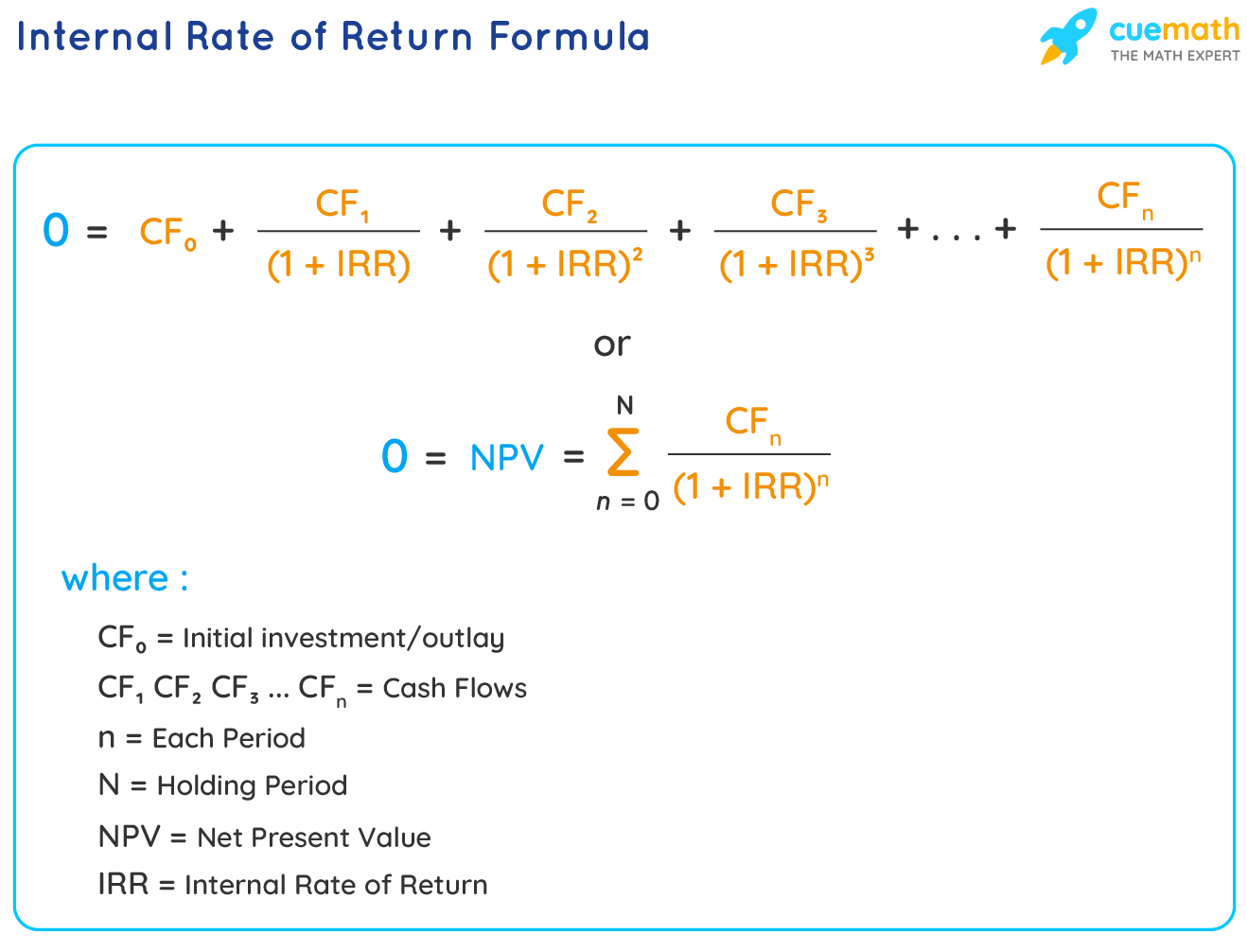

How to increase internal rate of return. The formula for calculating cagr is: The internal rate of return is the discount rate (interest rate) that makes the net present value (npv) of all cash flows from a particular project equal to zero. Evaluate investments using the internal rate of return (irr) approach.

Financial analysis the formula for calculating the internal rate of return by the investopedia team updated july 30, 2021 reviewed by charlene rhinehart. Return on investment—sometimes called the rate of return (r… What is irr (internal rate of return)?

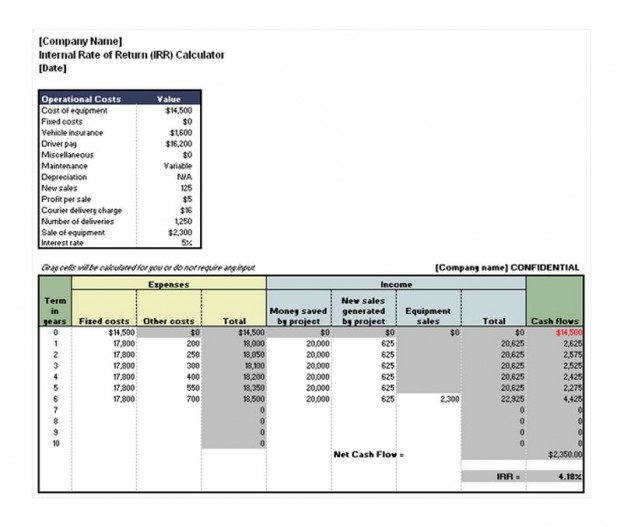

Internal rate of return, or irr, is the rate of return at which a project breaks even and is used by management to. The internal rate of return (irr) determines the worthiness of any project. What are npv and irr?

Jul 22, 2022, 1:00 pm pdt internal rate of return (irr) is one metric investors can use to calculate the potential return of investments. A small difference in the rate of return will result in big difference after several years of compound interest effect. Irr is one of the most popular capital budgeting.

It is also known as. But some accounts pay more interest than others. Internal rate of return (irr) is the discount rate at which the net present value of an investment is zero.

In addition, the irr determines the efficiency of a project in. Internal rate of return (irr) explained. If you're ready to take charge of your savings, we cover five ways to increase your interest earnings.

Vikki velasquez the internal rate of return (irr) is frequently used by companies to analyze profit centers and decide between capital projects. You will get more than. Just look at the chart below.

Internal rate of return (irr) is a financial metric used to assess the profitability of an investment by determining the discount rate that makes the net present. Using the internal rate of return (irr) to evaluate. The irr formula is calculated by equating the sum of the present value of future cash flow less the initial investment to zero.

Internal rate of return (irr) = (future value ÷ present value) ^ (1 ÷ number of. Key takeaways the internal rate of return rule states that a project or investment should be pursued if its irr is greater than the minimum required rate of. The formula for calculating the internal rate of return (irr) is as follows:

:max_bytes(150000):strip_icc()/IRR_final-9761b2cb70aa42eca108db9f04d3e8c5.png)