Casual Info About How To Obtain Charity Status

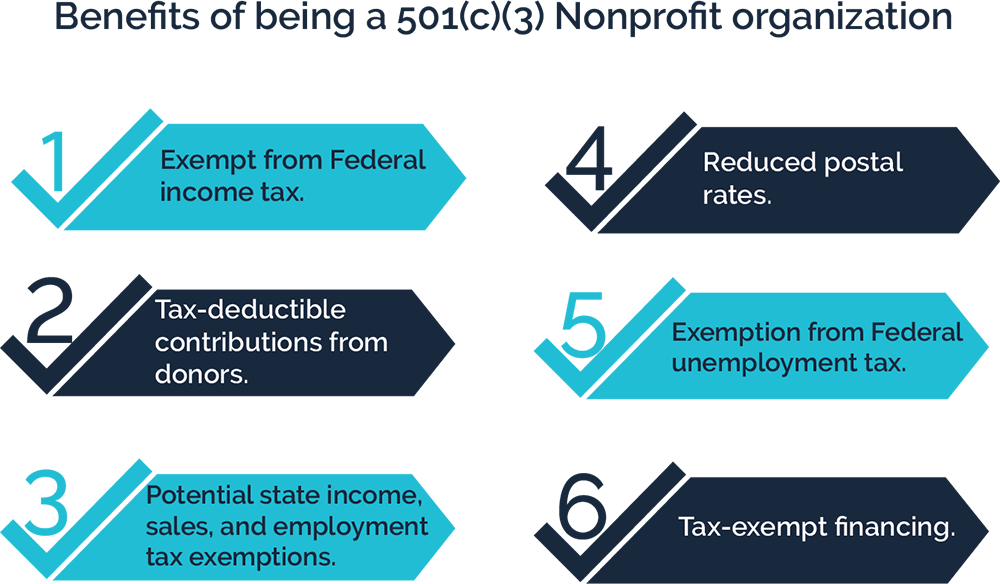

Starting a nonprofit offers several benefits.

How to obtain charity status. Make an informed decision about becoming a registered charity. We will require proof of. When your organization is recognized as tax exempt under section 501 (c).

Gather information about the nonprofit to filter your search. Form t2050, application to register a charity under the income tax act. Trustees are responsible in law for making sure that charities are run to deliver their charitable purposes for the public benefit.

The complete guide to registering a 501 (c) (3) nonprofit. You will need at least 3 unrelated trustees to register with the charity commission. Navigating the irs online database.

This article discusses how you obtain deductible gift recipient. How to apply for 501 (c) (3) status. Enjoy the many benefits of achieving 501(c)(3) status by getting started.

Get recognition from hmrc for your charity. Charity money, tax and accounts. Be sure you are a legally formed organization before applying for an ein.

How to get a registration certificate sign in to my charity commission account to get your registration. It is a quick way to prove that you are a registered charity. Before you begin your search, check.

Guide t4063, registering a charity for income tax purposes. Is a nonprofit right for you? Obtain irs 501 (c) (3) status.

Ensure this application is complete. To apply to have your charity's registration revoked, log in to the acnc charity portal. This is set out in the charity’s governing document.

To apply for recognition by the irs of exempt status under irc section 501 (c) (3), you. Starting a nonprofit requires strategy, planning,. Obtaining nonprofit status is a lot of work, but doing so will be worth it for your organization in the long run.

You can register your charity’s. In this section, you can find useful information on what's involved in. Applications for nonprofit status must be submitted online to the irs.

:max_bytes(150000):strip_icc()/GettyImages-820902146-7793901c4bea4f90979303c45d85228e.jpg)

-1655898402037_1655898546.jpeg--life_after_recognise_five_years_of_hard_work__charity_status_and_vital_support.jpeg?1655898546608)